|

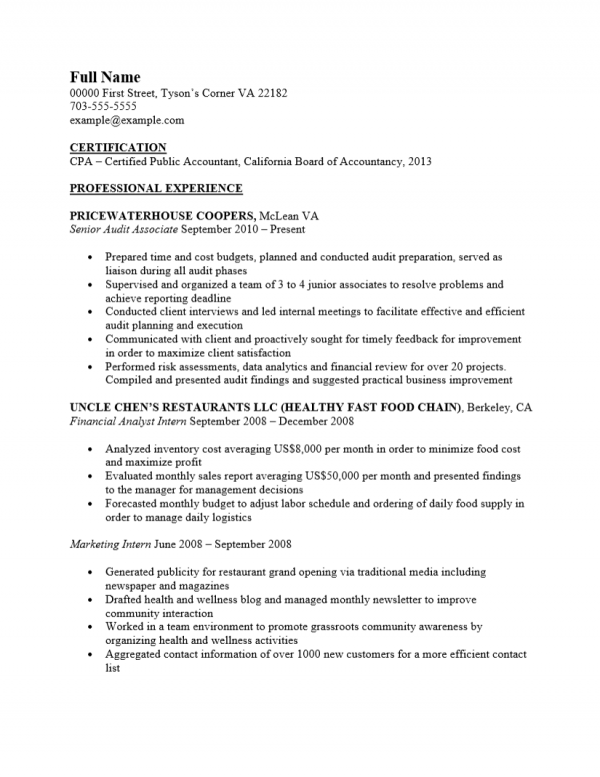

Certified Public Accountant (CPA) Resume Template |

The Certified Public Accountant (CPA) Resume Template gives CPA’s who need to quickly create a resume an advantage by providing a reusable form for creating such a document. Certified Public Accountants will need to present their credentials and experience in an organized manner then send it to a recruiter in a timely fashion. This is especially true if they are seeking opportunities any time near the end of a quarter or anywhere near ‘tax time’.

In order to use this form effectively, it is wise to organize one’s information before starting, glance at the headings then write a brief outline for each one. Applicants should make sure that a reasonable amount of time has been set aside for these tasks. A user then only needs to compose the content for each section. All of the information should be delivered in a succinct fashion. Job hunters should keep in mind this document will be, for all due purposes, an image of themselves being sent to a potential employer. Recruiters will weigh an applicant’s resume against other resumes and use the information it contains to determine which applicants will be called in for an interview. Therefore, it is in the best interest of the job hunter to produce a high quality resume that has been geared towards the receiver and delivered in a timely fashion.

How to Write

Step 1. Enter your name and contact information at the top of the page.

Step 2. The first section is named “Certification.” This is where you will declare the title of your certification. This must include the state you are certified in and the year you attained it.

Step 3. Your employment history should be reported in the “Professional Experience” section. Each previous employer’s entry should list several pieces of information. The employer name, location, job title and time period employed should open each entry. There must also be a detailed list of your duties for each employer.

Step 4. The “Activities” section will be where you list any extracurricular undertakings that relate to accounting.’

Step 5. In “Education” report the college you attended, degree earned, year of graduation and GPA.

Step 6. The “Additional Skills” section is where you are able to list any additional capabilities, experience, or knowledge you possess that is relevant to working as a CPA but not mentioned in any of the previous sections.